Problems Raising Capital Is An Example Of

One prominent proposal would be to tax capital gains. Expensive means of financing.

Debenture Example Angel Investors Accounting And Finance Business Basics

Small rivals will have a much higher average cost that prevent them from competing with.

Problems raising capital is an example of. This article is intended to provide readers with a deeper understanding of how the capital raising process works and happens in the industry today. Raising cash by issuing capital stock is an example of. For example a firm that controls what software may be installed on a large number of mobile devices thus preventing open competition for games and other apps.

There is an expression that goes people dont plan to fail they just fail to plan. Three natural barriers to entry are. Economies of scale problems raising capital and control of resources.

For instance they may have questions regarding intellectual capital such as which patents you hold or what experience you have. Raising cash by issuing capital stock is an example ofa. Examples include when a firm buys a machine that will last 10 years or builds a new plant that will last for 30 years or starts a research and development project.

Firms can raise the financial capital they need to pay for such projects in four main ways. Examples of financing decisions include securing a bank. ErA rf flA ErMrf 005072013005 01076 The risk premium of the stock market is the difierence between the return on the market and the risk-free asset or 135 8.

Debt capital is capital that has been raised through borrowing from a source outside the company. Raising money through equity finance might prove to be expensive in the case where the company is not already listed on the stock exchange. An externality inefficient output and price.

Raising capital for a startup or small business is without question one of the most challenging aspects of growing a business. Problems raising capital patents and copyright law and licensing. Finding Energy in Rejection.

Lisa can offer debentures to investors to raise money. Many of the problems with capitalism have to do with anti-competitive practices whereby firms prevent fair competition. If you want to raise capital be prepared to answer questions regarding the forms of capital you have.

In this case the company will have to go through objectives like IPO and underwriting. A strategic approach to fundraising coupled with patience and thoughtfulness in every step pays off. 1 from early-stage.

Control of resources economies of scale and licensing. Problems raising capital is an example of a natural barrier. Problems raising capital is an example of.

Cornerstones of Managerial Accounting 6th Edition Edit edition Solutions for Chapter 15 Problem 3MCQ. 2b The companys equity is worth 360 million and is. The cost of capital follows from the CAPM relation.

This is considered to be a time-consuming as well as an expensive task. No entrepreneur going into business does so with a plan to fail but inadequate access to working capital and other financing options is a huge contributor to a businesss lack of success and. Capital Raising Process An Overview.

The stories are manifold of entrepreneurs and small business owners becoming both frustrated and discouraged by the amount of time it takes to secure capital the rejections they endure and the lack of linearity and progress checkpoints over the course of the. One of the biggest challenges of funding and entrepreneurship. Control of resources patents and copyright law and economies of scale.

Financing decisions determine how a firm will raise capital. Firms often make decisions that involve spending money in the present and expecting to earn profits in the future. A Common Reason a Small Business Fails.

For more information on capital raising and different types of commitments made by the underwriter please see our underwriting overview. Chapter 1 The Financial Manager and the Firm Self Study Problems 11 Give an example of a financing decision and a capital budgeting decision. One approach to both reduce inequality and raise revenue is to reform the taxation of capital gains.

Economies of scale natural barrier to entry in an industry that enjoys large economies of scale production costs opera unit continue to fall as the firm expands.

Frontend The Web Visual Editor By Xchema Kickstarter Frontend Mit License Web Based Application

Case Interview Practice Consulting Business Business Problems Consulting

Infographic What S The Difference Between Angel Investors And Venture Capital Quickbooks Angel Investors Venture Capital Startup Infographic

Lateral Thinking Cards Lateral Thinking Creative Graphics Cards

7 Major Problems To Avoid During Mergers And Acquisitions Realty Times Merger Good Lawyers Legal Firm

Crowdsourcing Is Actually Using The Skills And Enthusiasm Of People Outside A Company Who Are Pr Infographic Marketing Social Media Training How To Raise Money

Turnstone Securities Tile Logo Brand Names And Logos Logo Design

Pin By Marte On Startup In 2021 Png Images Venture Png

10 Funding Options To Raise Startup Capital For Business

Design Of A Marketing Brochure For Tcla Brochure Design By Toast In 2021 Brochure Design Brochure Corporate Brochure

The Problem Solution Fit Canvas Problem And Solution Solutions Critical Thinking Skills

Use This Problem And Solution Powerpoint Template To Show Challenges Faced By Business Powerpoint Templates Business Powerpoint Templates Problem And Solution

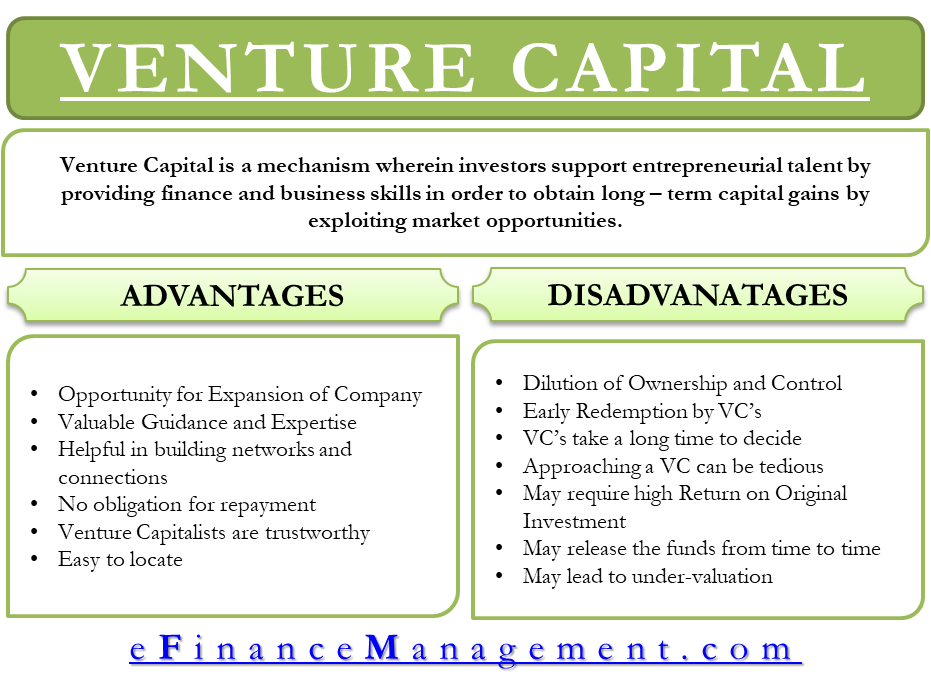

Advantages And Disadvantages Of Venture Capital Efinancemanagement

Us Cpa Accounting Marketing Jobs Accounting And Finance

Lean Startup Vs Design Thinking Which Method Should You Be Using Lean Startup Entrepreneurship Startups Design Thinking

A Sample Donor Appreciation Certificate Network For Good Learning Center Learn How To Raise Certificate Of Appreciation Network For Good How To Raise Money

The Gaming For Good Trend Need To Know Sxsw Personal Improvement Better Trends Best

Posting Komentar untuk "Problems Raising Capital Is An Example Of"