How To Record Income Tax Refund In Xero

Receive your income tax refund. You may wish to utilise the Business Portal.

Xero Tax Return Error Resolved In 4 Quick Steps Software Solutions 1 800 579 0391 Call Now Accounting Helpline

Related Client - select the related client from the list.

How to record income tax refund in xero. A business has many expenses. I will assume this tax refund related to income tax from last year - and that last years accounts are already closed. Also once you pay the tax the tax return can be kept up to two years.

Check the client record and select the BranchCACICA. Enter the refund amount into your general ledger to reverse the tax payment transaction. Enter a Payroll Journal onto Xero.

Xero Tax Planner Pro. We account for this by the following end of year journal entries. But there are ways to legitimately lower your profits in the eyes of the IRS.

If a tax refund was expected then likely there was a tax receivable item already setup somewhere. Use the following entries to show you received an income tax refund. Time better spent with Xero.

Confirm that the clients ABN TFN or CAC match the ATO portal. The ATO or your Tax Accountant can provide copies of these. Xero calculates the VAT return box amounts in line with HMRCs standard rules for VAT.

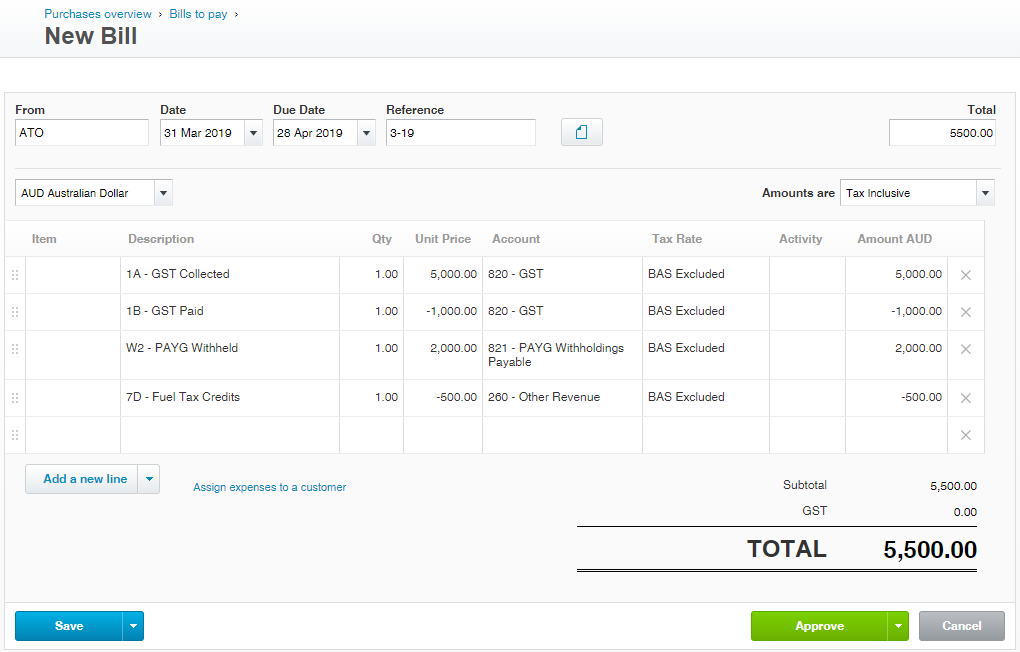

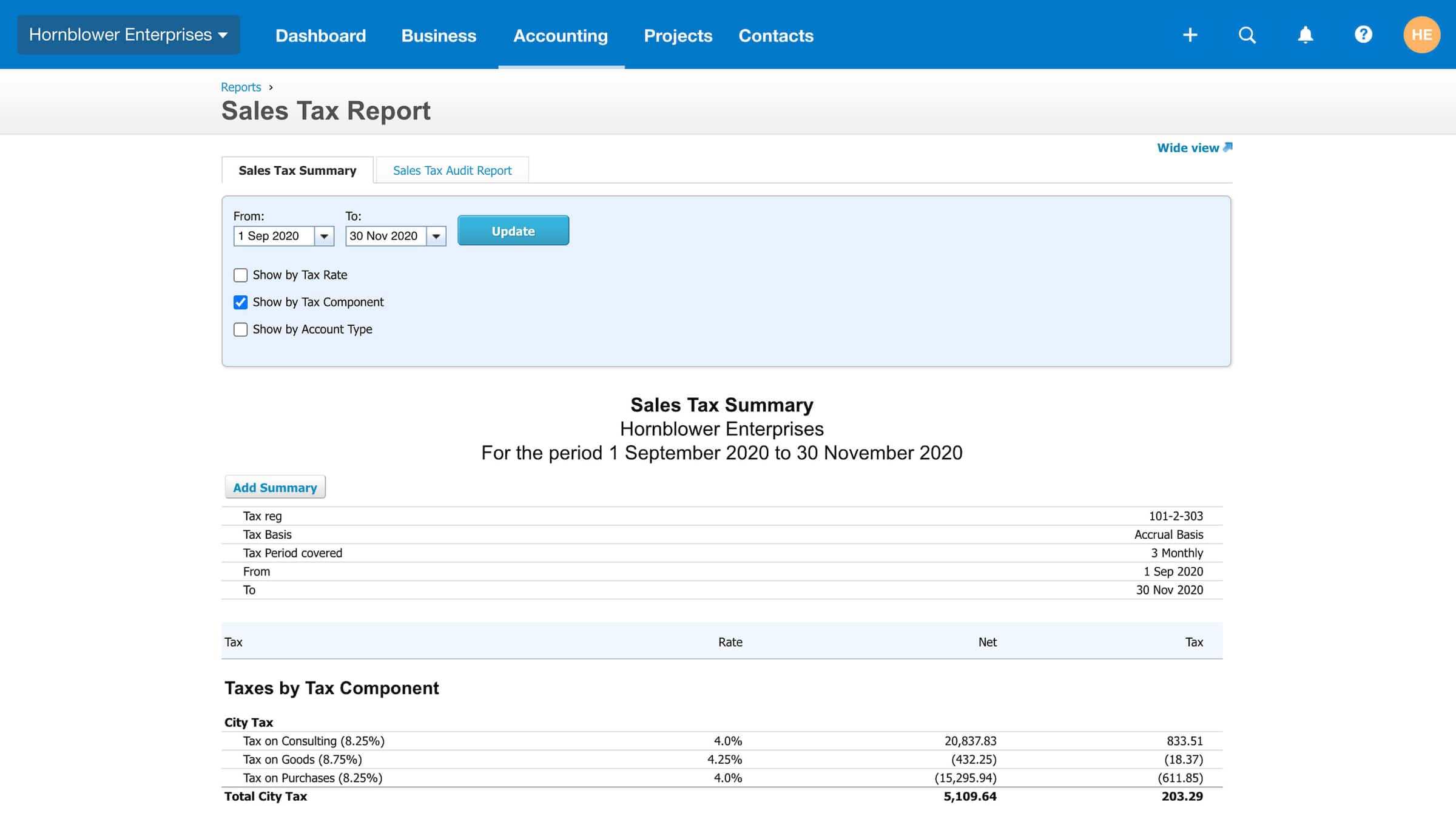

After just completing my state tax return it was a nightmare. To view the transactions that make up the totals on the VAT return select the Transactions by VAT box tab. For GST refunds allocate it to your GST system account and for PAYG related refunds allocate it.

Tax Type - select the appropriate tax type for the related clients return. Im also seeing income tax recorded as an expense which is not really correct as it relates to the previous financial year and is not a deductible expense. Create a new pay item as an Allowance and a new expense account Tax Refund Suspense Account.

By default Tax Refund relates to GST refunds but if you are processing all taxes from Tax payablereceivable the Tax refund method would be appropriate. Sole Trader Accounts For sole traders Xero Tax can produce unincorporated accounts and populate the relevant income. Thats why most businesses get an accountant to prepare their income tax return.

Journal to the GSTPAYG control accounts and a clearing account. Credit your Income Tax Expense account. Hi no it isnt a purchase and it doesnt go to Income Tax Expense.

Xero doesnt handle it right Im pretty sure or I am entering everything incorrectly. You can not journal directly to the bank account in Xero 3. Enter the details of your GST payment to IRD or the GST refund you have received and allocate the amounts to your GST 820 account.

If you have any fees interest or penalties allocate this to an appropriate account other than GST account. The Company Tax Rate is 285 and thus the projected tax payable will be 1425000. Reconcile the refund in your bank account using find match.

Select the new pay run and enter in your refund amount as an Allowance allocated to the new suspense account. Box 1 VAT due in the period on sales and other outputs. This is where things get technical and the stakes are high because your returns will be checked by government tax experts.

Now available for you to prepare and file personal tax SA100 tax return forms with supplementary pages some supplementary pages in development as well as SA302. This is little video to help our clients how to sign documents online from Xero Practice managerNote. Credit Income Tax Payable 1425000.

This account is for your JobKeeper Top Up payment reimbursements. Income Tax Account Integrated Client Account. It could be in Accounts receivable or it could be a negative Account payable or it may be in its own GL account.

The higher they are the more tax you pay. Generally you dont report loans you receive as income. Create a purchase bill when you woe money or sale invoice when you are due a refund.

Raj sorry but you cant specifically enter a PAYE refund into Xero at the moment. Theres an incorrect CACBranch number in the client record. Click on the Add Account button and choose the following settings.

It is also important for you as a taxpayer to amend the tax return. Any minimum tax credit available at the beginning of the tax year following the tax year of the debt cancellation multiplied by 3. The account number your chose following your number pattern.

In this video I will show you How To Enter a Refund In XeroWelcome in Marcus Stone Finances where I focus on wisely spending and wisely investing of your mo. Your Tax Return for FY15 from your information that expenses are greater than revenue would likely have no income tax to. Make sure you read and understand the return before si.

As a workaround we usually suggest that you do the following. Enter the details of your ATO refund. Any foreign tax credit carryovers to or from the tax year of the debt cancellation multiplied by 3.

Make an accounting entry for the income tax refund. Switching this number to 001 or 002 depending what number it is currently should resolve the error. How to record GST payments or refunds from IRD in Xero.

You should have a liability account to capture income tax payment. Add an invoice when you complete your BAS or IAS. When the refund we do the following.

In order to ensure that accurate and timely financial information is available to the business owners or other management to assist with decision making and the tax estimation process it is vital that these expenses are categorised correctly at the point of entry onto Xero or any other bookkeeping system used for. Debit Income Tax Expense 1425000. Debit your Cash account.

After filing the return the tax records can be kept for three years. Currently loaded videos are 1 through 15 of 46 total videos. When preparing an Income Tax Return I would like to have the option of having the Tax File Number displayed at all times whilst preparing the tax return.

First page loaded no previous page available. The duration of the three years is necessary for the IRS for auditing your income. Includes the VAT calculated on sales or income transactions for the period using any.

On the Job Information page scroll down to the Tax heading and complete the fields. Tax Year - select the correct tax year for the related clients return. Otherwise if you have created a separate expense account for company taxesthe best way to process refunds is to use the make deposit option into the account you paid the tax from.

Spend or Receive money at the time of payment.

What Is The Actual Process Of Document Management System Software Solutions For Any Organisation Document Management System Management Data Capture

Business Tax Timeline Annual Vs Quarterly Filing Synovus

How To Record Bas Payments In Xero Albany Accounting Consulting

Re Issuance Of Income Tax Refund How To Submit Request Online Tax Refund Income Tax Filing Taxes

Collaboration Is Key For Small Business Tax Compliance Cpa Practice Advisor

Will You Get A Second Income Tax Refund Irs Starts Issuing Unemployment Refunds Cpa Practice Advisor

Categorisation Of Income Tax Payments And Refunds

Faq S On Tax Return Record Keeping Rainysfinancials Bookkeepingforsmallbusiness Boo Book Keeping For Beginners Small Business Bookkeeping Self Assessment

Xero Practice Manager Individual Tax Return Xero Tv

Preparing Vat Returns And Gst Returns Xero Blog

How To Prepare Tax Returns How To Do Bookkeeping Xero Us

Oct 15 Is Tax Deadline For Extended 2020 Tax Returns Cpa Practice Advisor

How To Complete The Business Section In Mytax Youtube

Rideshare Deductions Standard Mileage Vs Actual Vehicle Expenses Rideshare Actual Deduction

Sole Trader Tax Return Accountants Company Tax Returns Melbourne Accounting Business Finance Tax Return

Tax Return Services Tax Return Accounting Services Self Assessment

Tax Return Fake Tax Return Income Tax Return Irs Tax Forms

Posting Komentar untuk "How To Record Income Tax Refund In Xero"