Net Incremental Cash Flow Calculator

Total cash flow is the amount of cash that comes into a business following the completion of a project. Calculation of incremental cash flow is done by adding the total cash inflow from the new project under consideration.

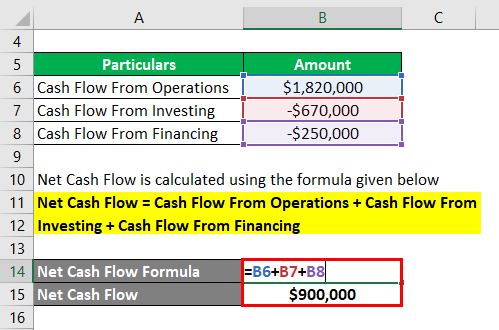

Net Cash Flow Formula Calculator Examples With Excel Template

In other words companies calculate cumulative cash flow over a certain period of time while incremental cash flows calculation.

Net incremental cash flow calculator. And then deducting all the initial expenditure for setting up the facilities and further operational expenses on that project. Incremental Cash Flow Calculator. Calculate Free Cash Flows for project.

The NPV Net Present Value Calculator will depend on the values input and reflect the information provided by the user. 100 per hour of cash inflow x 40 hours per week x 52 weeks per year 208000. NI is net income.

FCF NI D WC CE. Incremental Cash Flows in Year 1 are 200 million 500 million minus 300 million. Net cash flow 135000 Replacement Net Cash Flow-285000.

Incremental Cash Flows Example. How to Calculate the Incremental Cash Flow. F V P V 1 i n.

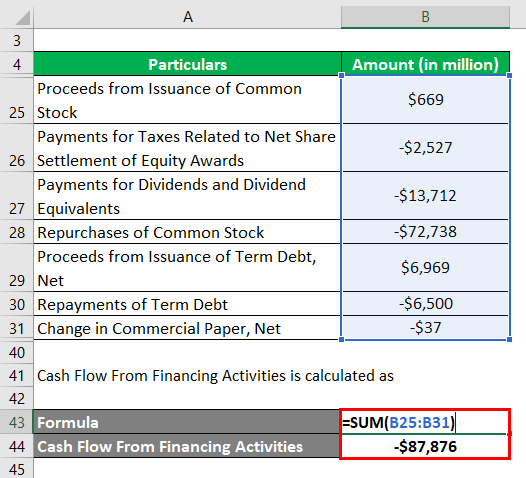

This figure is also referred to as operating cash Then subtract capital expenditure which is money required to sustain business operations from its value. Projecting incremental cash flows may also be. Should the buffet service be offered.

To estimate an incremental cash flow businesses must compare projected. To calculate FCF get the value of operational cash flows from your companys financial statement. CE is capital expenditure.

WC is change in working capital. The incremental change in cash flow represents a payback period of just over 10 years which is highly acceptable as long as the upgraded equipment can be expected. Why or why not.

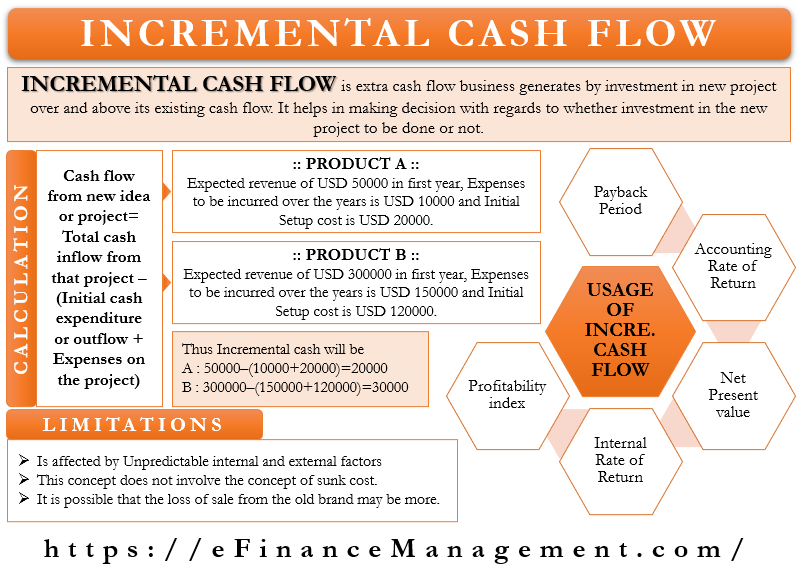

Then you can use the following incremental cash flow formula. See the formula below. Incremental cash flow projections are required for calculating a projects net present value NPV internal rate of return IRR and payback period.

Its calculated side by side to see the relationship between NPV and IRR. FCF Cash from Operations Capital Expenditure. The following equation can be used to calculate the free cash flow of a business.

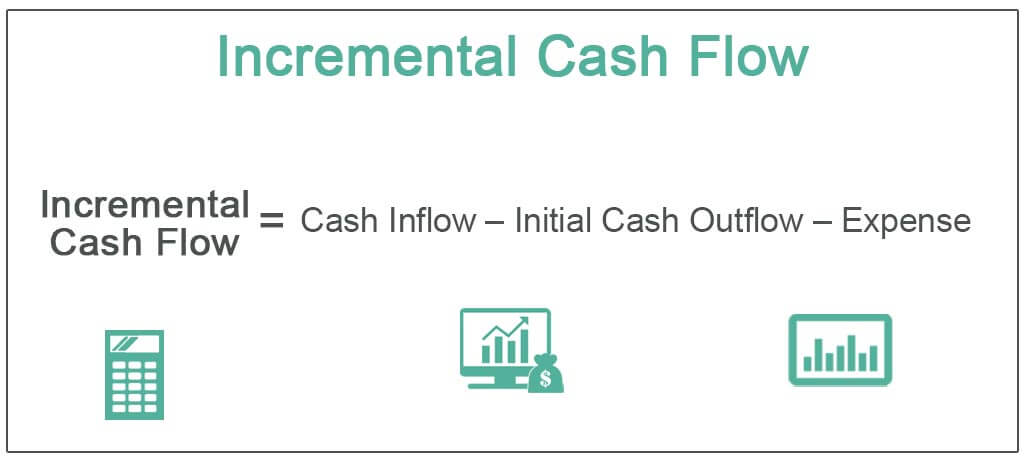

Incremental Cash Flow Revenues Expenses Initial Cost. Incremental cash flow refers to cash flow that is acquired by a company when it takes on a new project. You want to calculate the IRR for each project to help determine which machine to purchase.

Free Cash Flow Formula. They are projecting that Machine 1 will produce cash flows of 210000 in Year 1 237000 in Year 2 and 265000 in Year 3 and they are projecting that Machine 2 will produce cash flows of 181000 in Year 1 190000 in Year 2 and 203000 in Year 3. Project Management Project management is designed to produce an end product that will make an impact on an organization.

This NPV IRR Calculator calculates both your net present value and the internal rate of return on an investment with net cash flows. Incremental cash flowrefers to the additional cash flow a. Substituting cash flow for time period n CFn for PV interest rate for the same period i n we calculate future value for the cash flow for that one period FVn F V n C F n 1 i n n.

Greys Anatomy Ltd is contemplating opening a new retail outlet in a suburban. For example a company could use the net incremental cash flows to decide whether to invest in new more efficient equipment or to retain its existing equipment. The NPV Net Present Value Calculator above will discount each annual cash flow by the required rate of return provided and sum them to provide the final result.

ABC is considering investing in new machinery which costs 500000. It is where knowledge skills experience and. Net incremental cash flows are the combination of the cash inflows and the cash outflows occurring in the same time period and between two alternatives.

Enter values for cash flows and depreciation and taxes. Where FCF is free cash flow. Base on the projection the company will be able to increase the sale of 1 million per year with 40 of variable cost.

Learning how to calculate incremental cash flow is relatively straightforward. Incremental initial investment of Project E over Project F is 400 million 600 million minus 200 million. Assume that Warren Buffets has the necessary capital and places a 20 before-tax opportunity cost on those funds.

You just need to know a couple of basic pieces of information about your businesss finances. One way is to calculate the net present values of both projects. Incremental cash flow is the prediction of cash flow to come into a business if they work on a new project.

Depreciation Expense Taxes and Cash Flow Depreciation expenses is subtracted while calculating the firms. Another approach is to calculate incremental IRR as follows. Incremental cash flow example.

It has a useful life of 5 years with a scrap value of 50000. Calculate the incremental cash flow which is equal to the incremental sales minus incremental operating expenses plus changes in noncash operating expenses. Calculate net incremental cash flows for the Sunday buffet.

If our total number of periods is N the equation for the future value of the cash flow.

Net Cash Flow Formula Calculator Examples With Excel Template

7 1 Cash Flow Analysis 07 Chapter 7

Present Value Of Cash Flows Calculator

Net Cash Flow Formula Calculator Examples With Excel Template

Free Cash Flow Calculator Calculator Academy

Incremental Cash Flow Meaning Calculation Uses Limitations

Fcf Formula Formula For Free Cash Flow Examples And Guide

Free Simple Hr Cost Benefit Analysis Template In Google Docs Word Apple Pages Template Net Templates Analysis Document Templates

Incremental Cash Flow Definition Formula Calculation Examples

Incremental Cash Flows Formula Example Accountinguide

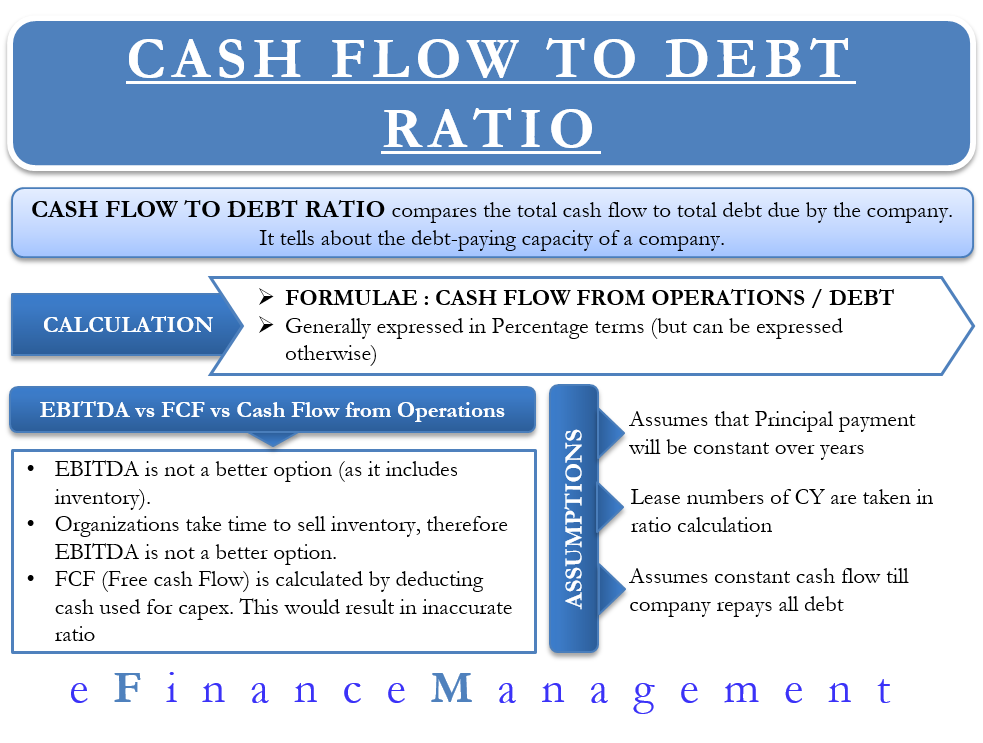

Cash Flow To Debt Ratio Meaning Importance Calculation

Calculating Project Incremental Cash Flows And Npv Atlantic Manufacturing Is Considering A New Investment Project That Will Last For Four Years Cash Flow Financial Analysis Investing

Solved Problem 08 014 Calculating Incremental Cash Flows Chegg Com

Incremental Cash Flow Definition Formula Calculation Examples

Uncover All Hidden Lifecycle Ownership Costs Find Tco In 6 Steps Life Cycle Costing Cost Life Cycles

Estimating Operating And Terminal Incremental Cash Flow 1 2 Youtube

Net Cash Flow Formula Calculator Examples With Excel Template

Net Cash Flow Formula Calculator Examples With Excel Template

Fcf Formula Formula For Free Cash Flow Examples And Guide

Posting Komentar untuk "Net Incremental Cash Flow Calculator"