Setting Up A Scholarship Fund Irs

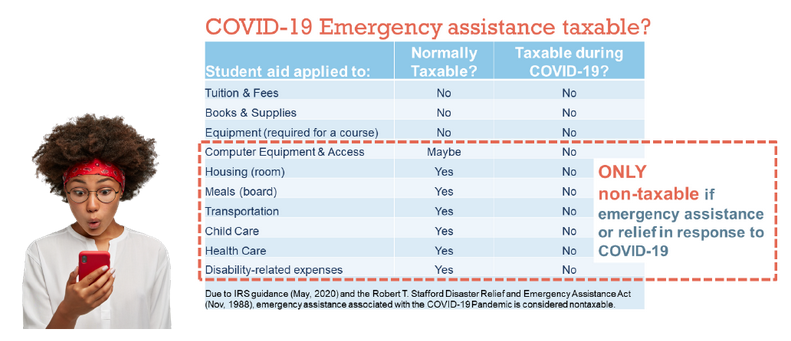

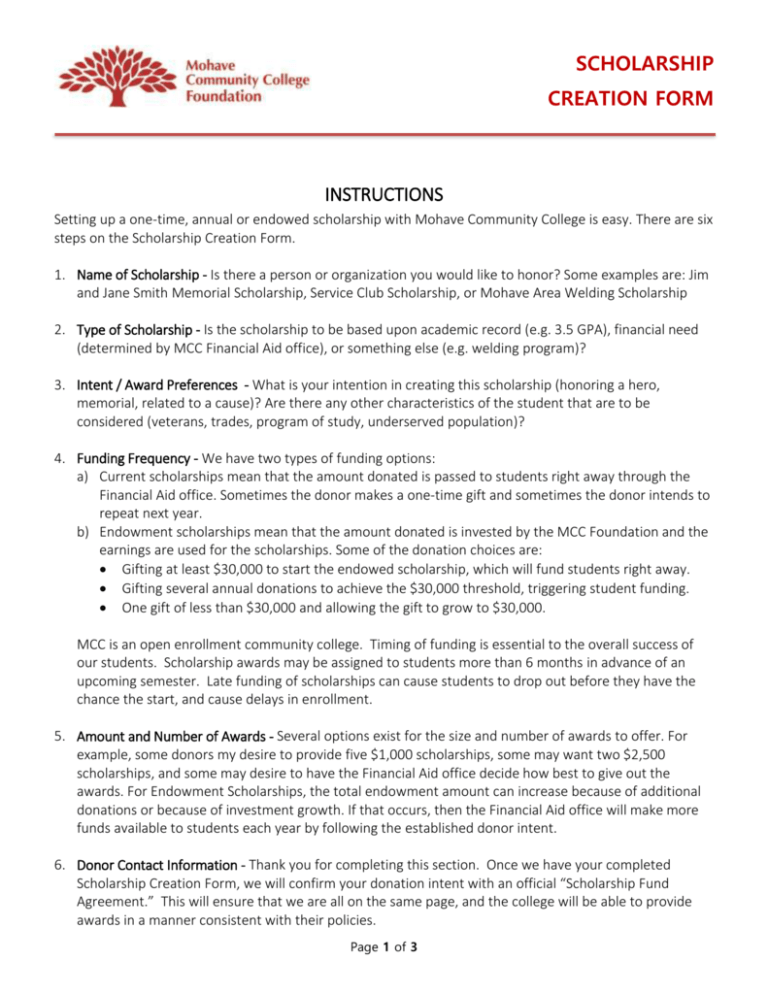

Scholarship grants awarded by these private foundations are taxable expenditures unless the grant programs meet the requirements for individual grants and receive advance approval from the Service. For a scholarship in someones name you may want to talk to people close to that person and ask if they would like to contribute to the fund.

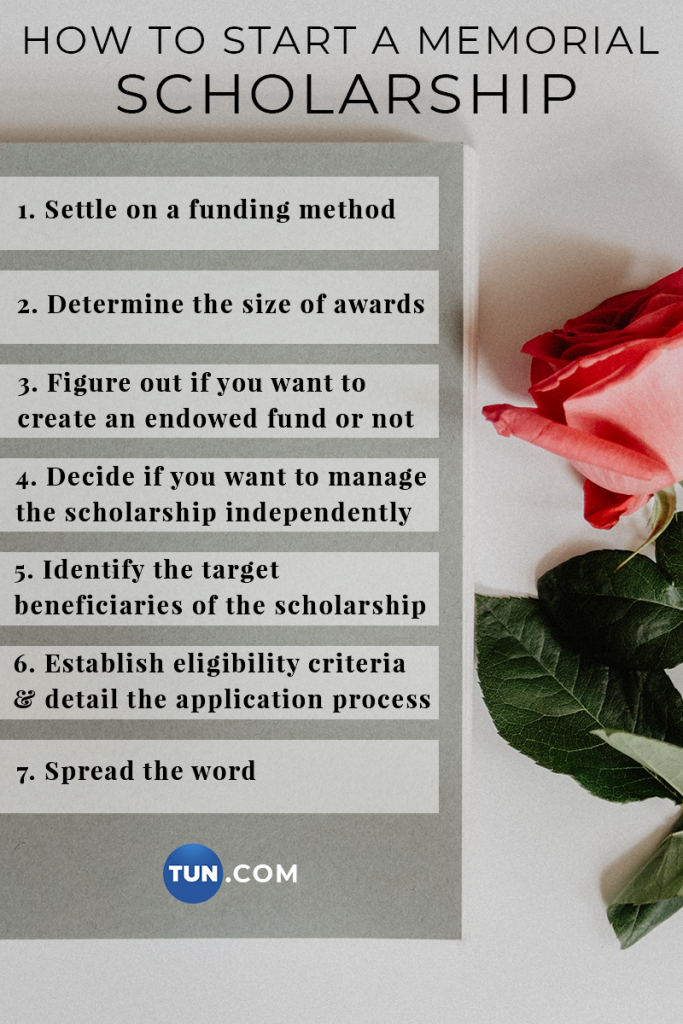

How To Start A Memorial Scholarship Tun

Although this means that donations are not tax deductible it does make a memorial fund easier to set up and manage than through a foundation.

Setting up a scholarship fund irs. Compliance Ensure the scholarship program is established and operated within the guidelines of state and federal law including the requirements of the Internal Revenue Service IRS. Consider Your Options A simple memorial fund remains open for a limited time -- most often no more than about six months --. Some of these steps you can easily do yourself.

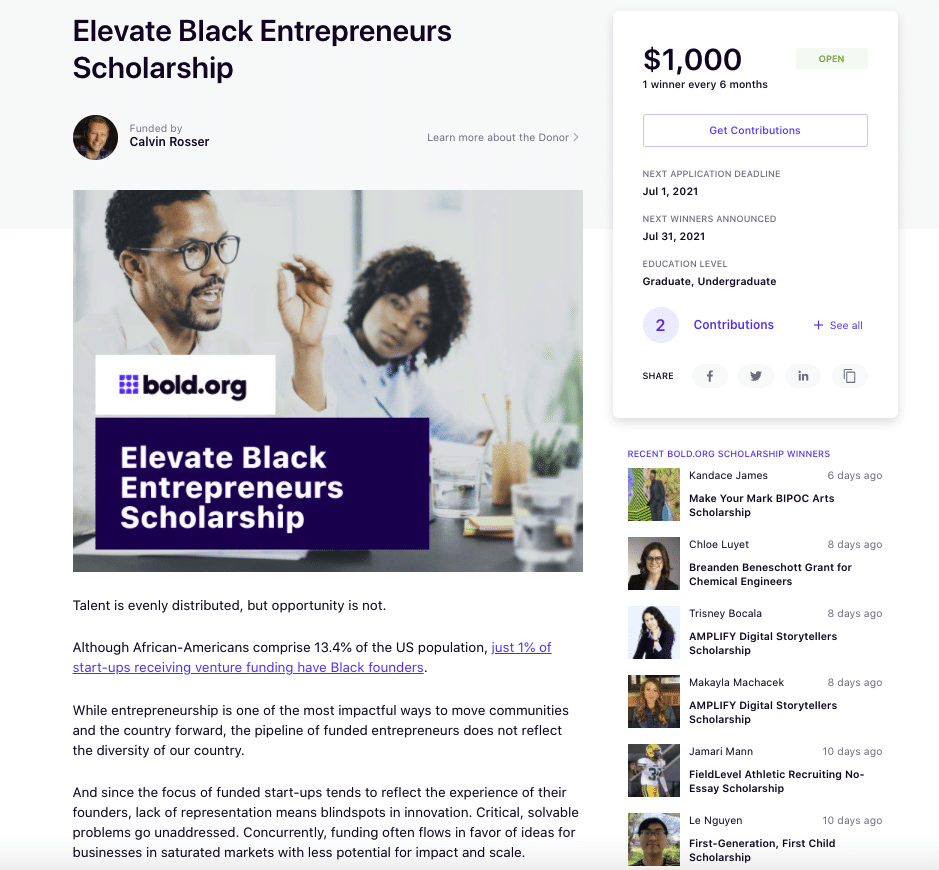

Just choose the type of payment credit card or e-check and youre good to go. To take advantage of Internal Revenue Service regulations regarding scholarships an organization needs to apply for advance approval before awarding grant monies. A scholarship program cannot run until the funds are available for award distribution.

The grant qualifies as a prize or award that is excludible from gross income under Internal Revenue Code section 74 b if the recipient is selected from the general public. Apply for recognition as a charity under 503 c 3 which confers tax exempt status. When youre setting up your scholarship you have the option of making it 100 tax-deductible through our Fund Manager.

Dont set up a fund for a specific person. Company scholarship programs will not qualify if grants are essentially providing extra pay an employment incentive or an employee fringe benefit. Understand the Tax Rules.

This is the section of. Setting up a scholarship fund essentially breaks down in to 8 simple steps. How to Set Up a Scholarship Fund You usually need at least 20000 but a college or community foundation will do most of the legwork.

Under Section 4966 of the Tax Code a fund will not be considered a donor-advised fund if all the following are true. One of the simplest ways to register your scholarship fund is through a community foundation though this may limit your say on the specific criteria youd like to use. If the person youre honoring left an inheritance you could use their estate to fund the scholarship program.

The sponsoring organization the community foundation appoints all of the members of the scholarship committee and the donors advice is given solely as a. Read this tip to make your life smarter better faster and wiser. Register your scholarship fund.

Follow IRS Guidelines When Setting Up a Scholarship Fund. Follow IRS Guidelines When Setting Up a Scholarship Fund. Set up a scholarship fund with seemingly neutral criteria that by wild coincidence your kid and nobody else meets.

Other items may require help. How to Set Up a Scholarship Fund The Ins and Outs of Setting Up a Scholarship Fund. Additionally many scholarships issue 1099 forms or similar documents to recipients so they can report the funds received from the scholarship on their own tax returns as required.

The IRS rules about foundation-based scholarship funds are designed to make sure that the procedure for awarding scholarships is not discriminatory and that a broad class of individuals have. You can also build a scholarship fund through donations. A recipient may use grant funds for room board travel research clerical help or equipment that are incidental to the purposes of the scholarship or fellowship grant.

People over age 70½ can now transfer up to 100000 tax. One of the factors that must be considered when setting up a scholarship fund is making certain that scholarship program is compliant with IRS regulations. Similarly if scholarship programs are compensatory in nature an organization administering such a program will not qualify for tax.

New scholarship funds can act as tax-exempt organizations by soliciting donations and filing the applicable tax returns while waiting for the IRS to decide on their application. LifeTips is the place to go when you need to know about Setting Up a Scholarship and other Scholarship topics. To obtain an EIN scholarship and memorial trusts can apply online over fax or through the mail.

Tax Status The scholarship fund must be registered with the IRS. Make sure the group that qualifies for your scholarship is general enough for the IRS to consider it a charitable class. Donors can also.

Apply for 501 c 3 status which is. Dont try to be sly by narrowing your criteria so that only the person or people you want can win. The going rate for setting up an endowed scholarship - one whose annual funds are created from the interest on the initial gift - requires at least 10000 preferably 25000 which offers about 1250 a year to a needy student Vaupel said.

Determine if you will run the scholarship or use a scholarship management service. To find a community foundation in your area use this community foundation locator. There are various types of scholarship funds so the first step is.

Simply choose your payment type the number of awards and how much the amount is. Establishing scholarships under IRS rules involves setting up compliant scholarship selection procedures supplying all requested information and filing paperwork with the federal tax agency. A good place to start is consulting IRS Section 4946.

Typically once you have finalized the requirements of your memorial scholarship program its good to plan for a minimum of 4 to 6 weeks for a program to launch.

How To Start A Scholarship Fund In 2021 Is It Worth The Effort

How To Set Up A Scholarship Fund In Memory Of Someone

Irs Letter 2840c Installment Agreement H R Block

The Big Questions About Scholarship Taxability Scholarship America

What Is Ss 4 Tax Form H R Block

How To Create A Scholarship Fund Howstuffworks

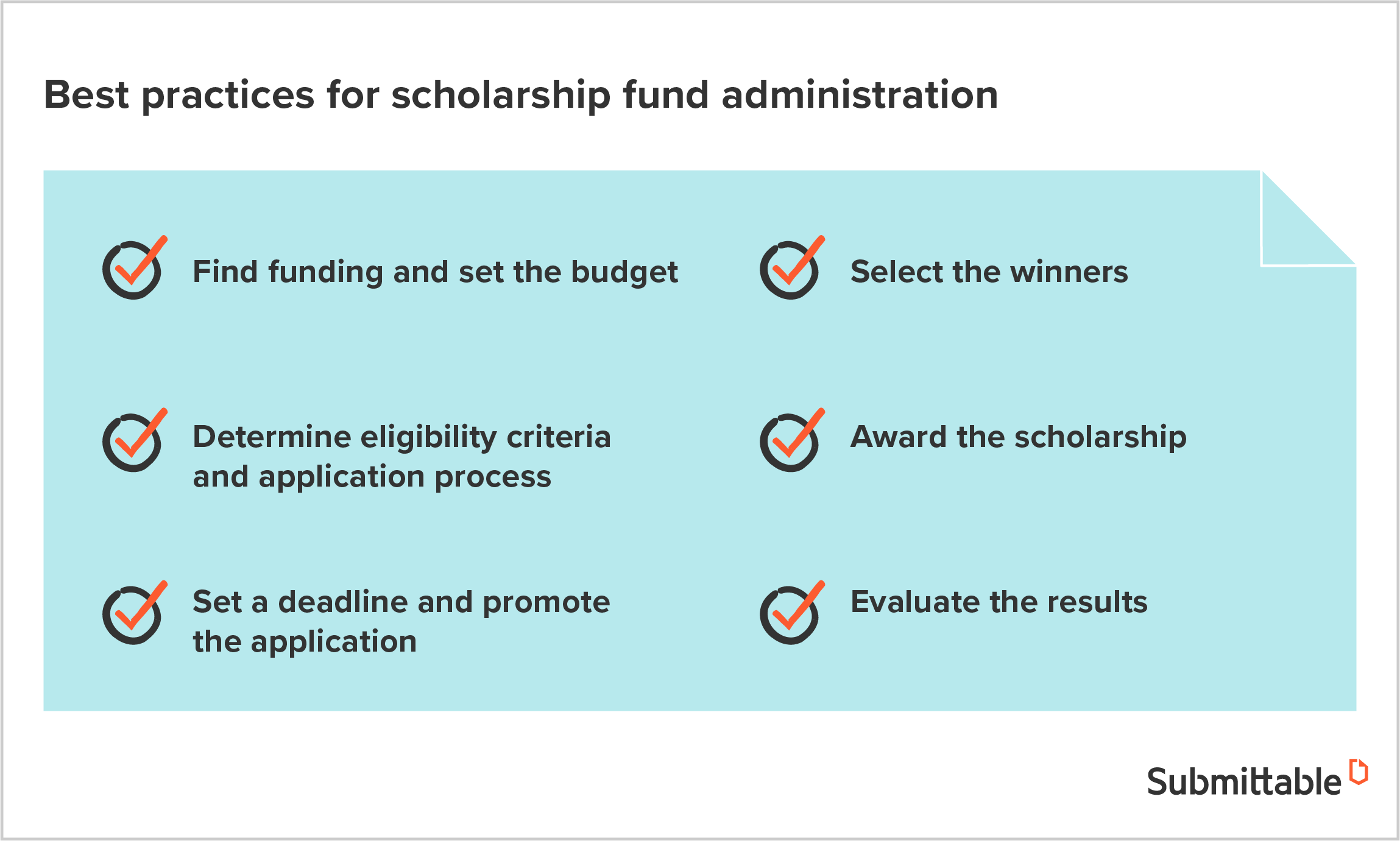

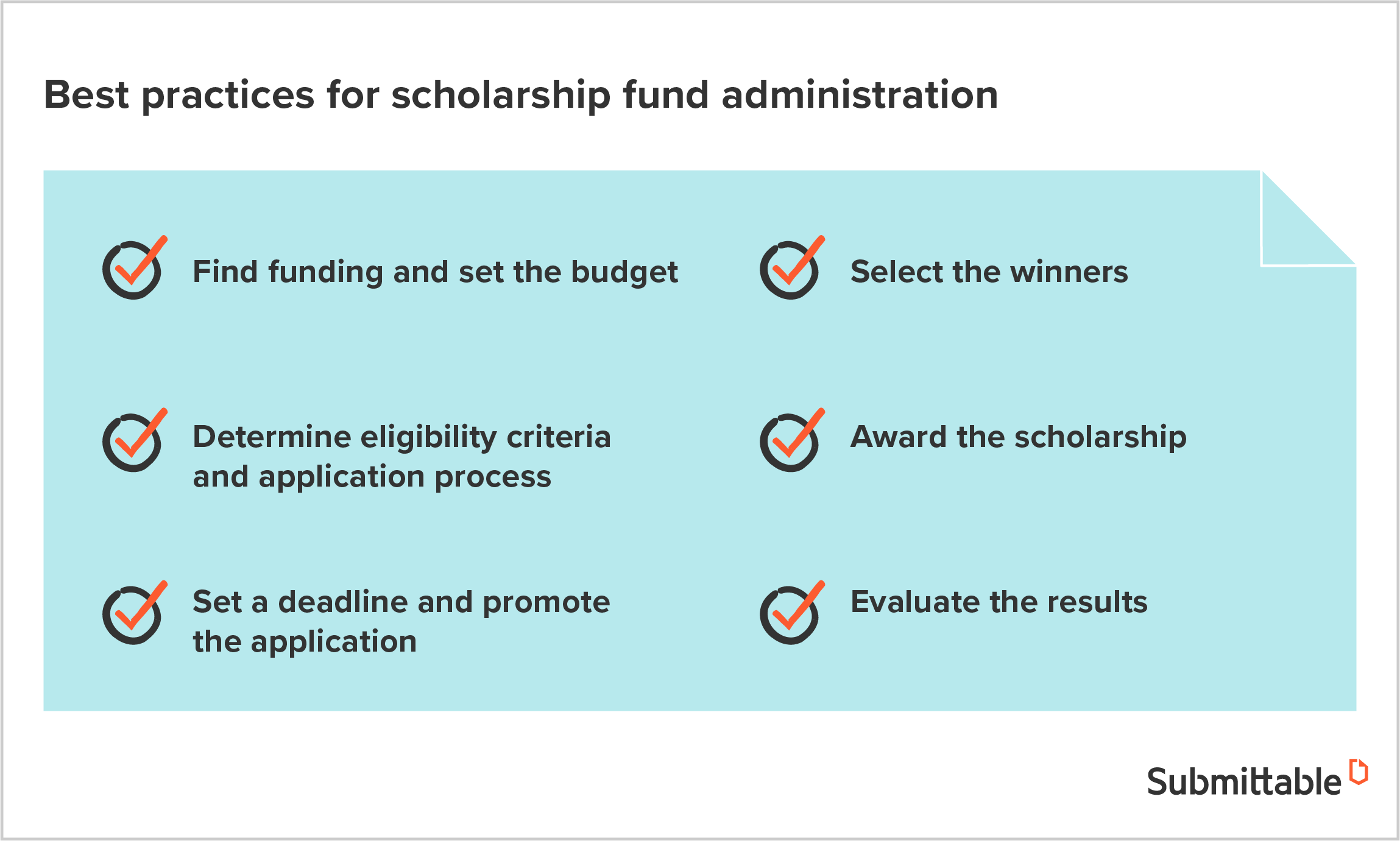

6 Best Practices For Managing A Scholarship Fund Submittable Blog

How To Start A Scholarship Fund Scholarful

Duplicate Of How To Create Your Scholarship Legacy Grand Island Public Schools

How A Nonprofit Can Set Up A Scholarship Legalzoom Com

How To Set Up A Scholarship Fund In Memory Of Someone

How To Start A Scholarship Fund In 2021 Is It Worth The Effort

6 Best Practices For Managing A Scholarship Fund Submittable Blog

How To Start A Scholarship Fund In 2021 Is It Worth The Effort

Posting Komentar untuk "Setting Up A Scholarship Fund Irs"