Indirect Material Cost Definition

Consider these costs as overhead costs. An indirect cost is any cost not directly identified with a single final cost objective but identified with two or more final cost objectives or an intermediate cost objective.

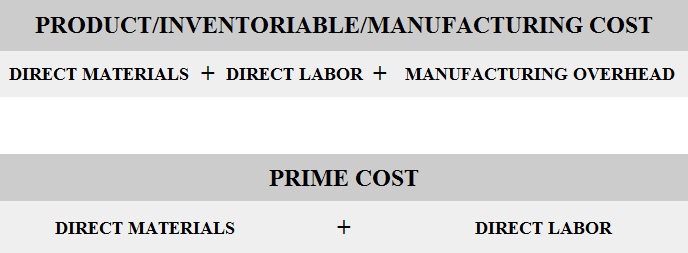

Describe And Identify The Three Major Components Of Product Costs Under Job Order Costing Principles Of Accounting Volume 2 Managerial Accounting

Indirect Materials Cost.

Indirect material cost definition. In accounting the indirect materials definition is a category of indirect cost. Indirect costs are expenses that cannot be traced back to a single cost object or cost source. An indirect material is a material that indirectly forms part of the finished product.

A common example of a direct cost is a material or equipment item purchased exclusively for one cost objective. They belong to a category of indirect costs. Indirect costs may be either fixed or variable.

The cost of indirect materials used is added to the entitys manufacturing overhead cost and thus ultimately made part of the total product cost. Indirect labor cost is the cost of labor that is not directly related to the production of goods and the performance of services. Indirect materials can be accounted for in one of two ways.

Glue nails rivets and other such items are examples of indirect materials. The first example of an indirect variable cost we will take is of the indirect material. By collecting indirect costs from sponsors UL Lafayette is recovering those expenses.

Some costs are for materials that are not considered direct materials and so are instead classified as indirect material costs. Indirect materials are resources used in a manufactures production process that cant be traced back to the products or batches of products they produce. During the manufacturing process items like products departments and customers create costs.

It is not subject to treatment as a direct cost. You can think of indirect materials like resources used to assemble direct materials into finished products. As we all know what is indirect material cost depends on the type of material that is used in the construction and the amount of money that need to be invested.

The selection from the either approach is largely impacted by the entitys costing policies. It cannot be directly charged to the unit or the order. Indirect costs are costs that are not directly accountable to a cost object such as a particular project facility function or product.

Like direct costs indirect expenses can be either fixed eg rent or variable eg utilities. Indirect cost is the cost that cannot be directly attributed to the production as these costs are incurred in general costs and can be fixed or variable in nature like the office expenses salary paid to administration sales promotion expense security and supervision expense etc. They are included in manufacturing overhead and are allocated to the cost of goods sold and ending inventory at the end of each reporting period based on some reasonable method of.

And one employees salary might be an indirect cost while anothers is a direct cost. Material as tools cleaning supplies lubricating oil used in manufacturing processes which does not become an integral part of the product and the cost of which is not identifiable with or directly chargeable to it compare direct material. Then treat them accordingly.

What is considered an indirect cost for one company might be considered a direct cost for another. It refers to the wages paid to workers whose duties enable others to produce goods and perform services. For example an employee on an assembly line receives wages that are considered direct costs.

Instead they are part of the real costs of conducting the outside funded RD. Unlike direct labor cost indirect labor costs are not so readily associated with specific units. Package material are indirect material cost because package materials are not utilized in manufacturing of units of products but required to package the finished goods so it is indirect material cost.

One of the main factors that needs to be understood is what is indirect material cost. These are considered cost objects because the original manufacturing costs stem from them. The federal government has established what costs may be charged as direct costs and what costs are considered included in indirect costs.

This is what costs money when it comes to the materials that are used during the construction process. Or the time spent by an employee working on one cost objective. In accounting we treat indirect materials as overhead costs or operating expenses and treat them accordingly.

However it cannot link them to a specific job or product. Indirect materials are materials that a company uses in the production process. Identifying your indirect expenses might be a little tricky.

For example lets take the case of a factory outlet which sales shoes. Indirect costs include administration personnel and security costs. Download the free Know Your Economics guide to monitor whats happening in your business.

Indirect costs are not profit. However if the amount is significantly minor the cost of these materials can be directly charged to expense as incurred during a period. Indirect costs are all costs that are not identifiable or incurred for the benefit of one cost objective.

Indirect materials are materials used in a production process but they are not directly traceable to a cost object. You can allocate indirect costs to determine how much you are spending on expenses compared to your sales. An indirect material is a material which is not used in the manufacturing process but it is used as part of the sales.

Definition of indirect material. These materials are so immaterial as not to be worth tracing to a specific product or cannot be clearly associated with a specific product.

Types Of Costs Direct Indirect Costs Fixed Variable Costs Efm

Cost Accounting Introduction Cost Meaning Cost Means The Amount Of Expenditure Actual Or Notional Incurred On Or Attributable To A Given Thing Ppt Download

Indirect Costs Example Uses How To Calculate Indirect Costs

Direct Indirect Expenses Definition Examples Video Lesson Transcript Study Com

Direct Vs Indirect Costs In The Construction Industry Lutz Accounting

Difference Between Direct And Indirect Expenses With Examples And Comparison Chart Key Differences

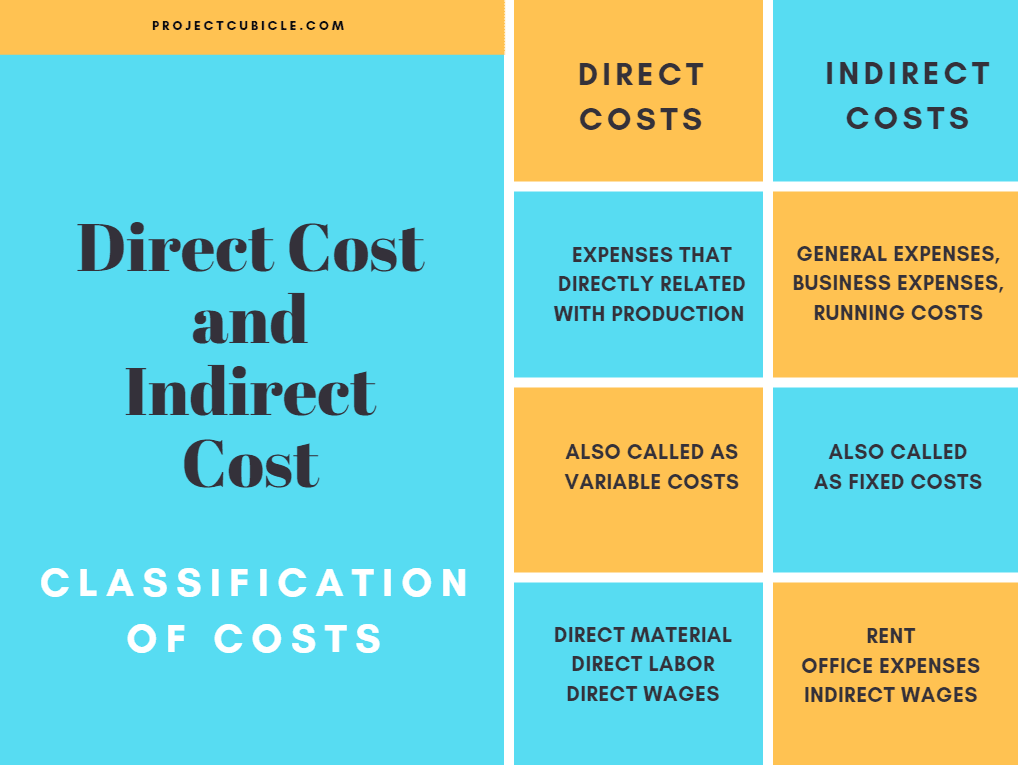

Direct Costs And Indirect Costs Cost Classification Projectcubicle

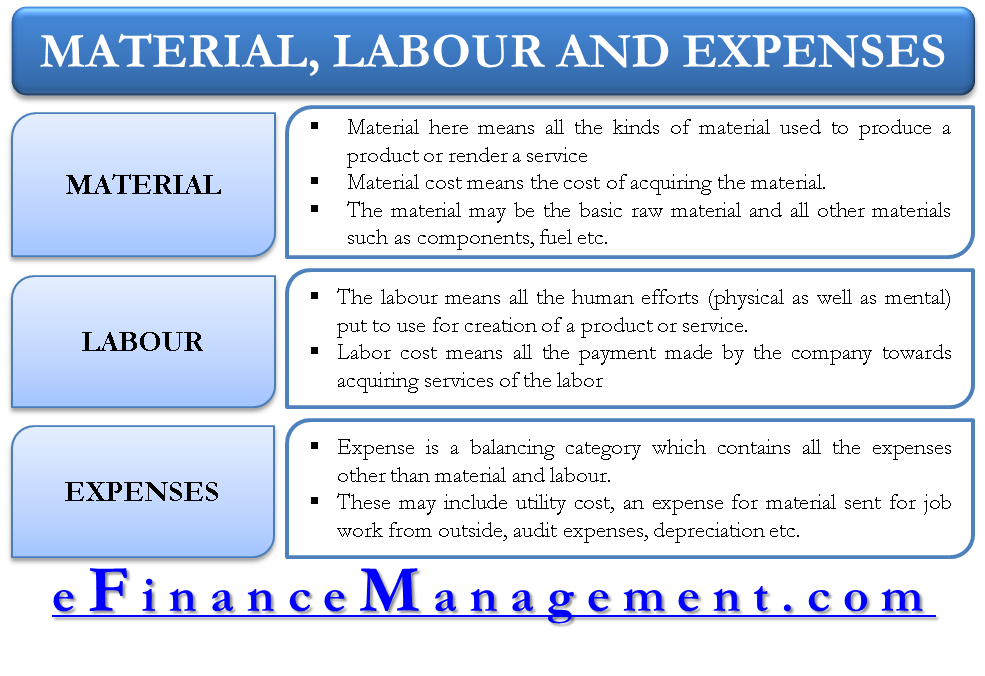

Material Labor And Expenses Classification Based On Nature Of Costs

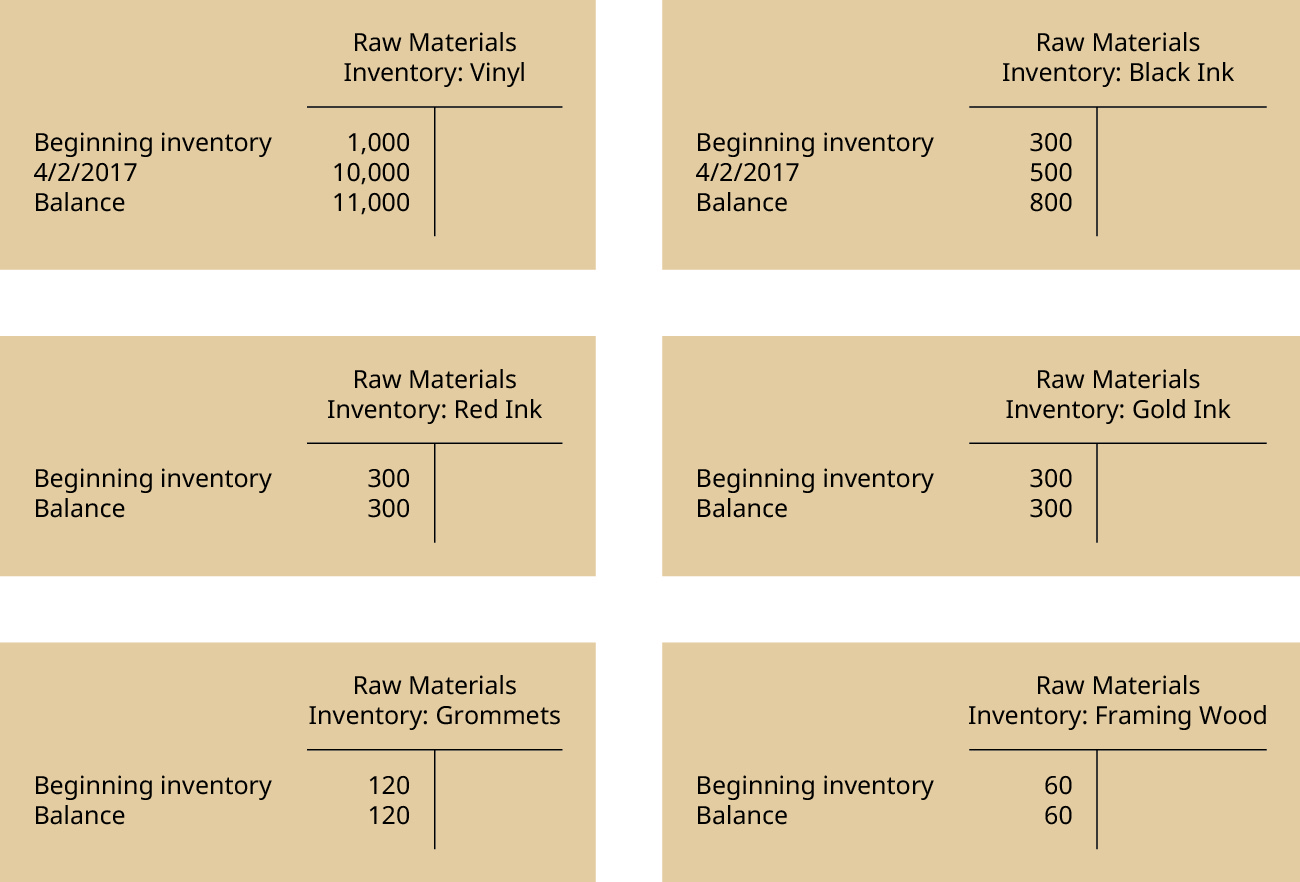

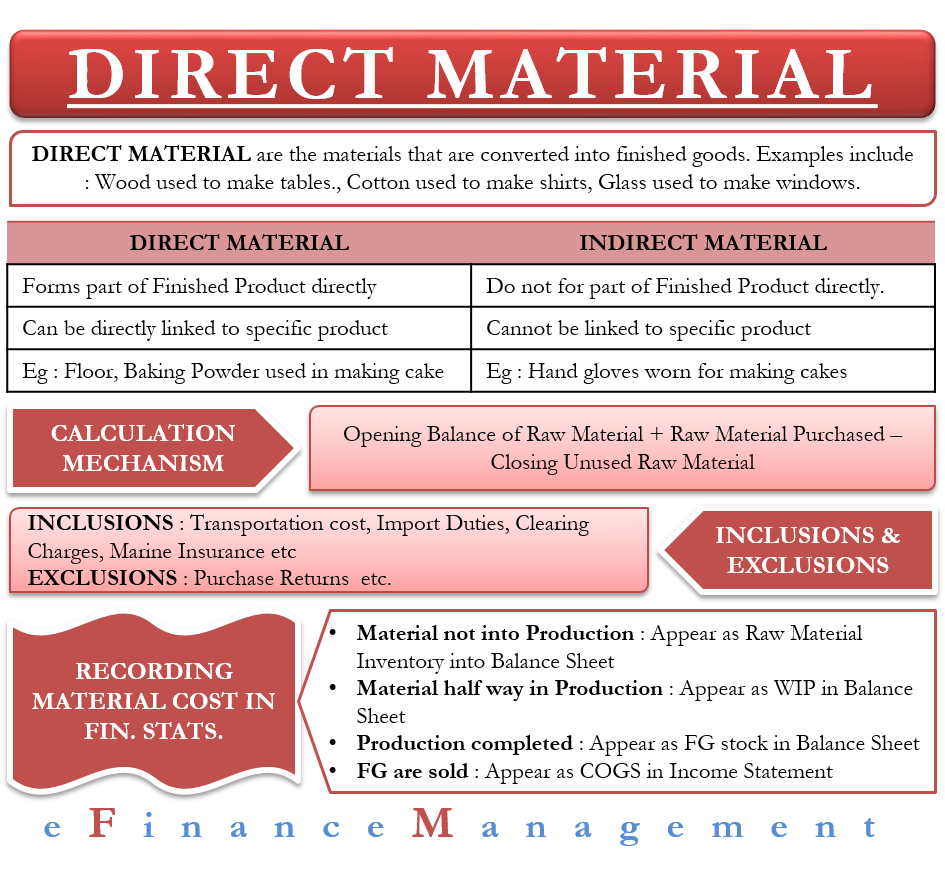

What Is Direct Material Examples Calculation In Financial Statements

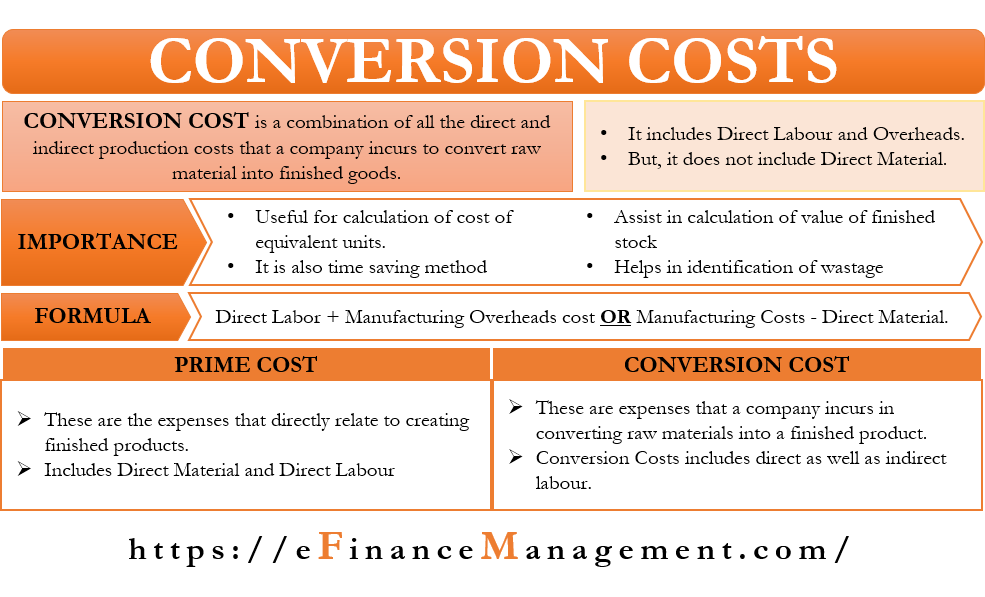

Conversion Cost Meaning Importance Formula And More

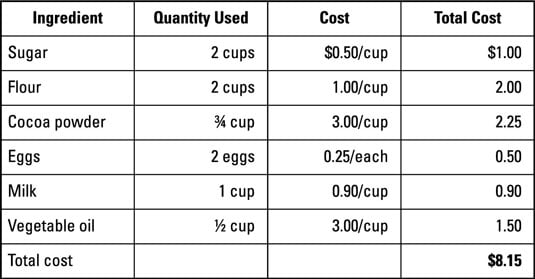

How To Distinguish Direct From Indirect Manufacturing Costs Dummies

Difference Between Direct And Indirect Cost With Comparison Chart Key Differences

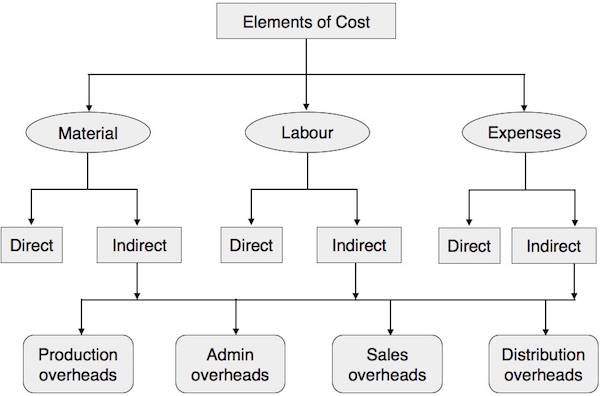

Cost Accounting Elements Of Cost

What Are Indirect Materials Definition And Examples

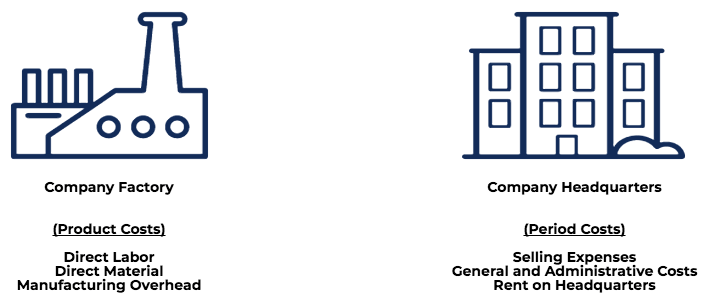

Product And Period Costs Double Entry Bookkeeping

Cost Accounting Introduction Cost Meaning Cost Means The Amount Of Expenditure Actual Or Notional Incurred On Or Attributable To A Given Thing Ppt Download

Direct And Indirect Materials Cost Definition Explanation Examples Accounting For Management

Product Costs Types Of Costs Examples Materials Labor Overhead

Posting Komentar untuk "Indirect Material Cost Definition"