Is Nj A Tax Deed State

Give us a call at 949-798-1180 or contact us online today to learn more. Bidding Process All auctions are by competitive bid and start by bidding the interest rate down.

Tax Certificate And Tax Deed Sales Pinellas County Tax

Vacant Land means land itself above and under water in its original indestructible immobile state.

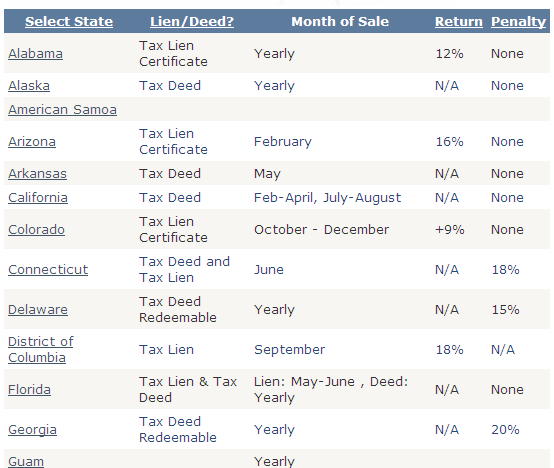

Is nj a tax deed state. According to New Jersey Law on tax lien certificate greater than 200 a penalty of 2 is added to the tax lien certificate tax lien certificates greater than 5000 bring a 4 penalty and tax lien certificates greater than 10000 a 6 penalty is added. 40 rows PTD-SI. Hunterdon County collects the highest property tax in New Jersey levying an average of 852300 191 of median home value yearly in property taxes while Cumberland County has the lowest property tax in the state collecting an average tax of.

NJ Tax Records Search. If a property owner fails to make timely property tax payments the property may be subject to tax foreclosure either by the municipality or by a third party who has bought the tax lien from the municipality. A New Jersey Property Records Search locates real estate documents related to property in NJ.

Though often referred to as State Aid programs these are actually Revenue Replacement programs. New Jerseys property tax problem. The Fee is required to be paid upon the recording of deeds conveying title to real property in New Jersey.

Vacant land is idle land not actively used for agricultural or any other purpose. However on residential real estate transfers valued at or above 1000000 the Buyer pays an additional 1 transfer fee to the state. Tax liens offer many opportunities for you to earn above average returns on your investment dollars.

250 Real Property Tax Deduction Supplemental Income Form. 93 rows NJ Tax Relief for Hurricane Ida Victims. Generate Reports Mailing Labels - Maps Include.

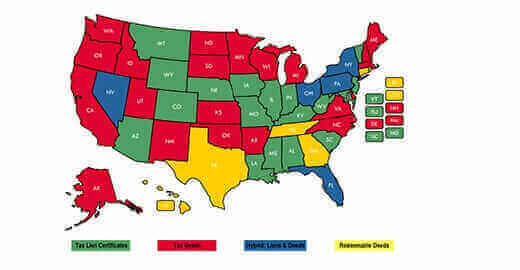

Some municipalities include an additional 6 year end penalty on tax lien certificates. State of New Jersey Government NJ Taxes. New Jersey Tax Liens Yearly 18 2 Years New Mexico Tax Deeds Varies NA NA New York Tax Liens Deeds YearlyVaries 20 NA.

Section 1812-22 - Property classifications with definitions a Class 1. If the certificate is not recorded with the county all you have is a piece of paper and no lien. Forms are sent out by the State in late Februaryearly March.

Treasury Announces NJ Division of. For residents who did not receive a prior years reimbursement or Form PTR-2 for residents who did. Click here to do so.

For information call 800-882-6597 or to visit the NJ Division of Taxation website for information and downloadable forms. Access our statewide collection of NJ Tax Maps Property Records Ownership Assessment Data Sales History Comparable Properties. Check your New Jersey tax liens rules.

State of New Jersey Revenue Processing Center PO Box 222 Trenton New Jersey 08646-0222. The Seller pays the state transfer tax. Address Block Lot Owners Last Name - Deed Date Sale Price Acreage Absentee Taxes Year Built and more.

The county clerk will attach the top portion of Form GITREP-1 to the deed when it is recorded and will forward the bottom portion NJ-1040-ES and the estimated tax payment to. The deadline to file. Senior Freeze Property Tax Reimbursement Program.

Find New Jersey Property Records. Currently in the state of New Jersey. The leading provider of real estate information for the state of New Jersey.

The State of NJ site may contain optional links information services andor content from other websites operated by third parties that are provided as a convenience such as Googleâ Translate. Levering data from official sources we provide additional data beyond other sites such as the Monmouth Tax Board web application. Tax Title Services is here to help you with your tax deed and title insurance needs today.

ALTERNATIVES TO THE PROPERTY TAX STATE REVENUE REPLACEMENT FUNDING There are two main formula-driven general municipal property tax relief programs currently in use in our Garden State. Tax Zoning Flood Aerial GIS and more. Leftover liens not sold at the tax lien sale may be sold over the counter New Jersey is a very competitive tax sale state however and if there are any liens left over they are usually for junk properties.

And payment with the deed the county clerk will not record the deed. Public Property Records provide information on land homes and commercial properties including titles property deeds mortgages property tax assessment records and other documents. If you do not see a tax lien in New Jersey NJ or property that suits you at this time subscribe to our email alerts and we will update you as new.

The procedures that govern tax foreclosure are set down in the Tax Sale Law NJ. Dont waitif youre living in a tax deed state and want to start on the tax deed investment process reach out to Tax Title Services today. State Of New Jersey Division Of Taxation Property Administration May 2007 Realty Transfer Fee NJSA.

The exact property tax levied depends on the county in New Jersey the property is located in. And is land in an approved subdivision actively on the market for sale or being held for sale. NJ Division of Taxation - NJ Division of Taxation - Senior Freeze Property Tax Reimbursement statenjus.

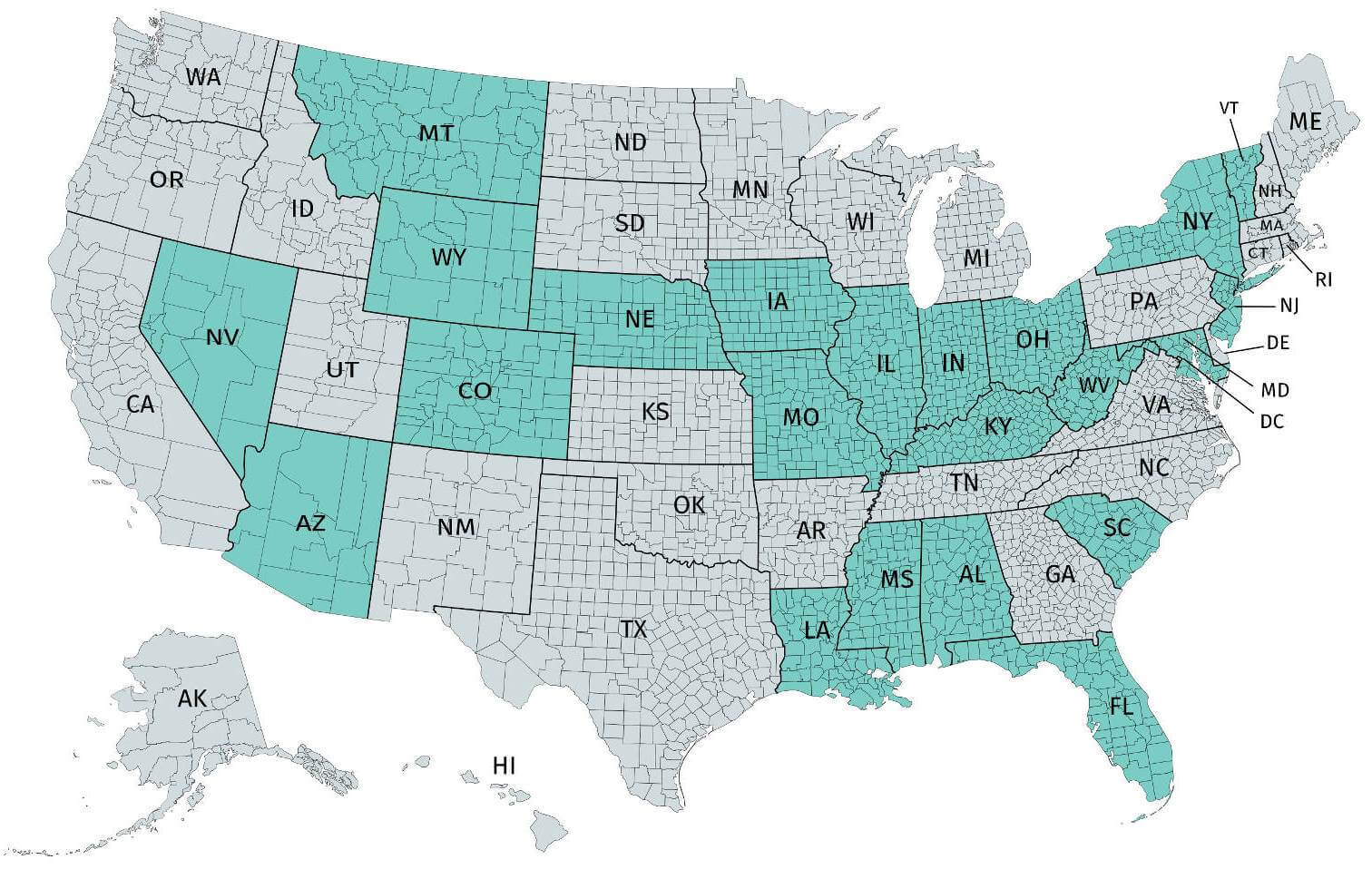

The state of New Jersey is ranked 46th in Recorders Of Deeds per capita and 6th in Recorders Of Deeds per square mile. Up to 20 cash back City county andor state tax stamps may have to be purchased as well. Search NJ Tax Assessment Records - Search by.

There are 21 Recorders Of Deeds in New Jersey serving a population of 8960161 people in an area of 7353 square milesThere is 1 Recorder Of Deeds per 426674 people and 1 Recorder Of Deeds per 350 square miles. Perfect when looking to buysell your home. 4615-5 et seq The Realty Transfer Fee is imposed upon the recording of deeds evidencing transfers of title to real property in the State of New Jersey.

New Jersey does have tax deed sales. Search property tax assessment records for any property in New Jersey for free. Just remember each state has its own bidding process.

Tax Deeds Are They Legal In Your State A Guide Upnest

Complete List Of Tax Deed States Tax Lien Certificates And Tax Deed Authority Ted Thomas

Which States Are The Best For Buying Tax Liens Alternative Investment Coach

Tax Deed Sales Buying Homes By Paying Other People S Taxes Deeds Com

Tax Deeds Are They Legal In Your State A Guide Upnest

Where Are The Tax Sales Tax Lien Investing Tips

Kentucky Quit Claim Deed Form Quites Quitclaim Deed Kentucky

Tax Deed Horror Stories Watch This Before Your Purchase A Tax Lien Or Deed Youtube

New Jersey Quit Claim Deed Form Quites New Jersey Jersey

New Jersey Tax Sales Explained Tax Liens Tax Deeds A Goldmine For Real Estate Investors Youtube

Are Tax Deeds Legal In Your State A Guide To 2021 Investing

Complete List Of Tax Deed States Tax Lien Certificates And Tax Deed Authority Ted Thomas

Complete List Of Tax Deed States Tax Lien Certificates And Tax Deed Authority Ted Thomas

The Said Office Would Become Responsible In Organizing And Conducting Tax Deed Sales To The Public Tax Flash Drive Usb Flash Drive

Tax Sales Information Map State Information Ask Al How

Indiana A Tax Lien And Deed Investor S Dream By Saen Higgins

The Essential List Of Tax Lien Certificate States Tax Lien Certificates And Tax Deed Authority Ted Thomas

Posting Komentar untuk "Is Nj A Tax Deed State"