Useful Life Of A Website For Depreciation

Eventually as the assets value approaches zero the asset reaches the end of its useful life and no longer accrues depreciation charges. Current assets are not depreciated because of their short-term life.

Unit Of Production Depreciation Method Formula Examples

Consider a new warehouse building worth 1000000 with a standard useful life of 30 years.

Useful life of a website for depreciation. The table specifies asset lives for property subject to depreciation under the general depreciation system provided in section 168a of the IRC or the alternative depreciation system provided in section 168g. Useful life represents how long an asset is likely to be profitable to the business. Depreciation Utility 2 Improved Representation of Company Financials.

Website Tax Deduction Website costs can be broadly classified as either capital expenses or ongoing running costs. The estimated value of the land is 200000. _x000D_ Entire building including the shell and all components may be treated as a single asset and depreciated over a single useful life.

The depreciation charge reduces Net Income for that year as it is an expense. If your asking about Depreciation for Taxes Website domains are Section 197 Intangibles so they are amortized over 15 years. Thus within 2 5 years of the initial implementation of a website most organizations have their decaying websites redesigned rebuilt and given a complete make-over that leaves the site looking nothing like the original site.

Divide that by the useful life. The result would look something like this. These non-software portions of the design will have a useful life of no more than a year in which case the costs can be currently deducted Website content that is advertising is generally currently deductible.

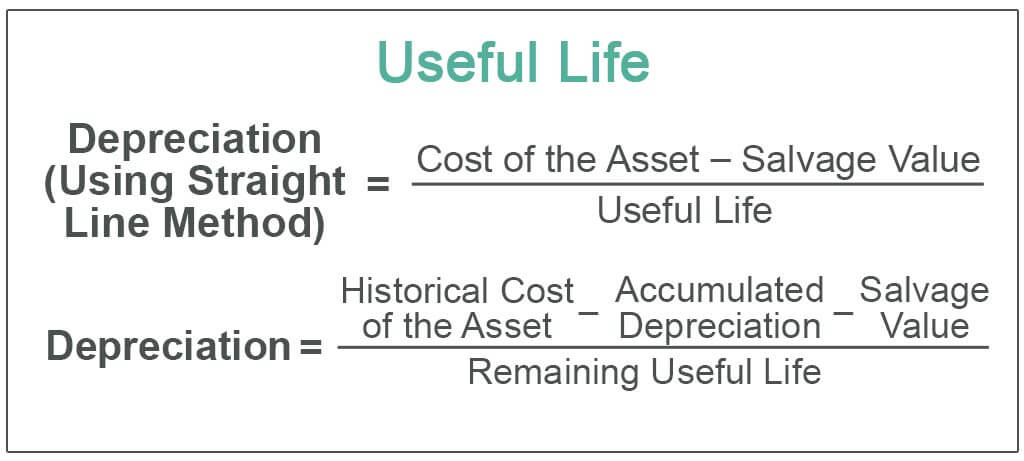

The old site is now dead. Straight Line Depreciation Method Cost of an Asset Residual ValueUseful life of an Asset. An asset is depreciated over its useful life which is the period over which an asset is expected to be.

Running costs maintenance will normally be deductible as a business outgoing. Direct costs - Costs assigned to activities by direct tracing of units of resources consumed by individual activities. Straight-line depreciation example.

21500 0 20 years 1075 annual depreciation. Simply because of changing technology and also the pace at which web designapplication software and techniques are expanding our experience is that a web sites design both internally and visually therefore its tangible value is being replaced every 18 months-2 years by our SME clients even on so called stable long term large sites we would argue that this is continually. The MACRS Asset Life table is derived from Revenue Procedure 87-56 1987-2 CB 674.

As such the treatment you choose is part of the disclosures that your make in your GAAP financial Statements. Subtracting the land value from the asset cost you get 800000. Thus these costs must be amortized over the number of years that it is expected that the non-software portions of the design will be used in the business except if it is expected that these non-software portions of the design will have a useful life of no more than a year in which case the costs can be currently deducted.

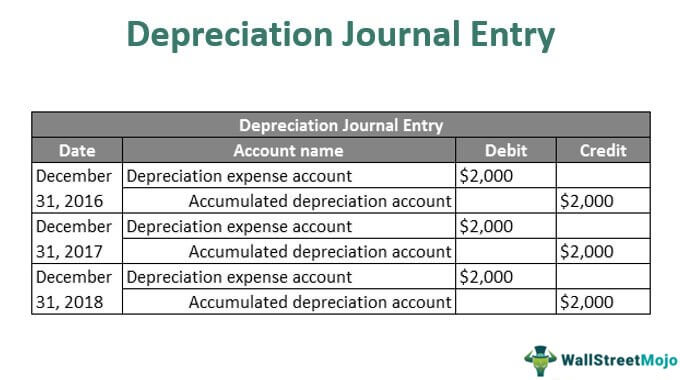

Depreciation is the method of accounting used to allocate the cost of a fixed asset over its useful life and is used to account for declines in value. The longer the assets useful life the lower its depreciation rate will be but. The treatment of other.

Depreciation - The systematic and rational allocation of the acquisition cost of an asset less its estimated salvage or residual value over its estimated useful life. If your asking about Depreciation for GAAP The accounting for a recognized intangible asset is based on its useful life to the reporting entity. The design structure and function of a website typically last 2 5 years.

Unit of Product Method Cost of an Asset Salvage Value Useful life in. Depreciation period useful life Depreciation starts when the asset is in the location and condition necessary for it to be capable of operating in the manner intended by management. It is used to calculate an assets depreciation while also helping inform maintenance and purchasing decisions.

Capital expenses may be deductible under a number of possible tax provisions based on the character and purpose of the expense. Depreciation method used to charge the cost of an asset or group of assets to accounting periods must reflect the pattern of consumption of the asset during its useful life. If we apply the equation for straight line depreciation we would subtract the salvage value from the cost and then divide by the useful life.

This is the same moment up to which directly attributable costs can be recognised as a part of the cost of PPE.

/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)

Why Is Accumulated Depreciation A Credit Balance

Straight Line Depreciation Accountingcoach

Macrs Depreciation Calculator Straight Line Double Declining

Definitions Depreciation In Fixed Assets The Monetary Value Starts To Decreases Over Time Due To Use Wear And T Fixed Asset Marketing Trends Explained

Depreciation Of Fixed Assets Double Entry Bookkeeping

Depreciation Of Building Definition Examples How To Calculate

Depreciation Formula Calculate Depreciation Expense

How To Calculate Uk Depreciation And Depreciation Rates Life Insurance Facts Life Insurance For Seniors Fixed Asset

Machinery And Equipment Depreciation Life 2 Mind Blowing Reasons Why Machinery And Equipment Mindfulness Life Mind Blown

Accumulated Depreciation Overview How It Works Example

Bookkeeping Accounting Financial Statements Zero To Pro Financial Statement Bookkeeping And Accounting Bookkeeping

Useful Life Definition Examples What Is Asset S Useful Life

Depreciation Journal Entry Step By Step Examples

It Asset Management Infographic Asset Management Management Infographic Tracking Software

Tomorrow Is The Builders League Of South Jersey Trade Show Expo If You Would Like To Attend Go To Their Website For M Expo Trade Show Accounting Information

Straight Line Depreciation Calculator Double Entry Bookkeeping Bookkeeping Straight Lines Double Entry

Printable Depreciation Schedule Template Schedule Template Templates Schedule

Posting Komentar untuk "Useful Life Of A Website For Depreciation"