How To Calculate Capital Adequacy Ratio With Example

The capital used to calculate the capital adequacy ratio is divided into two tiers. Capital Adequacy Ratio is like a banks airbag.

Capital Adequacy Is A Balance Sheet Ratio

What is the Capital Adequacy Ratio Formula.

How to calculate capital adequacy ratio with example. 5000 multiplied by 75 3750. Current liabilities are best paid with current assets like cash cash equivalents and. Tier one capital to total risk weighted credit exposures to be not less than 4 percent.

The formula for the Capital Adequacy Ratio is. What is Working Capital. The CAR or the CRAR is computed by dividing the capital of the bank with aggregated risk-weighted assets for credit risk operational risk and market risk.

Capital Adequacy Ratio or CAR is a measure of a banks ability to absorb losses. The rating system is on a scale of one to five with one being the best rating and five being the worst rating. It is part of todays Cash Adequacy Requirements.

Capital Adequacy Ratio for BOB Bank. Capital Adequacy RatioThe capital adequacy ratio CAR is a measure of a banks capitalIt is also known as capital-to-risk weighted assets ratio CRARIt i. New capital requirements will apply from June 2016 and will result in all Firms having to review and potentially increase the amount of assets set aside to meet the new minimum capital requirements.

Capital Adequacy Ratio for IDBI Bank. About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features Press Copyright Contact us Creators. Capital Adequacy Ratio 100000000 20000000 847457627.

Economic Capital and the Assessment of Capital Adequacy 5 Supervisory Insights Winter 2004 T he assessment of capital adequacy is one of the most critical aspects of bank supervision. Capital Adequacy Ratio 4000000057 30000000 5559968274. If the national regulator requires a capital adequacy ratio of 10 the bank is safe.

Capital Adequacy Ratio. For PIFs Personal Investment Firms the new requirement will be the greater of 20000 or 5 of the Firms Investment Business annual income. C A R T i e r 1 C a p i t a l T i e r 2 C a p i t a l R i s k W e i g h t e d A s s e t s.

Just keep in mind that a lower rating is better indicating a. Average total assets with certain adjustments serve. Practically this is the figure showing the financial strength of a bank and usually includes.

Capital Adequacy Ratio 1378. An institutions risk-weighted assets as defined by Part 324 serve as the denominator for these ratios. The working capital ratio is important to creditors because it shows the liquidity of the company.

Common equity tier 1 capital ier 1 capital and total t capital serve as the numerators for calculating regulatory capital ratios. Step of the calculation example. The Tier 1 capital ratio measures a banks financial health its core capital relative to its total risk-weighted assets RWA.

If the actuary departs from the guidance set forth in this ASOP in order to comply with. CAMELS is an acronym for capital adequacy assets management capability earnings liquidity sensitivity. The scope includes capital adequacy assessment work related to the design performance or review of a capital adequacy assessment whether for an insurers internal or external stakeholders for example a regulator.

Capital Adequacy Ratio 1259. This is calculated by summing a banks tier 1 capital and tier 2 capitals and dividing the total by its total risk-weighted assets. Capital Adequacy Ratio 7000000025 1000000023 5805515272.

The working capital ratio also called the current ratio is a liquidity ratio that measures a firms ability to pay off its current liabilities with current assets. In completing this assessment examiners focus on a comparison of a banks available capital protection with its capital needs based on the banks overall. CRAR Tier-1 Capital Tier-2 Capital Risk-Weighted Assets.

Capital Adequacy Ratio 1416. In other words it is similar to. Tier 1 capital under the Basel Accord measures a banks core capital.

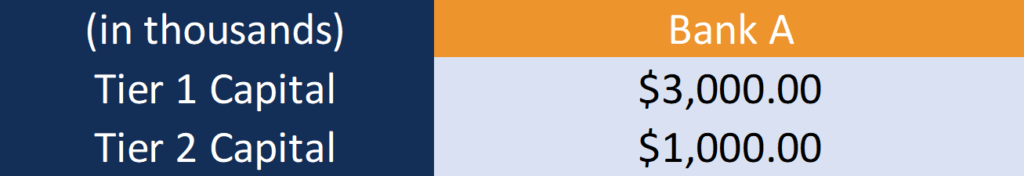

Total capital is the sum of tier 1 and tier 2 capital. Capital Adequacy Ratio Tier 1 Capital Tier 2 CapitalRisk Weighted Assets. How to calculate capital adequacy ratio with example The capital adequacy process takes both Tier-1 and Tier-2 capital into account using the following CRAR formula.

We calculate CAR by comparing the ratio of capital to risk. The calculation for their Tier 2 Capital Ratio would be as follows. Tier One Capital T1C is the core capital of a bank meaning that by considering this financial resource the bank will not requested to cease trading in case of losses.

CAR dfrac. Risk-weighted exposures 150 1510 820 610 37 million. Bankss total capital 200000 300000 500000.

CAR Tier 1 Capital Tier 2 Capital Risk Weighted Assets As the Risk Weighted Assets increase the CAR decreases as the banks ability to absorb the loss in assets using capital decreases. Minimum Capital Adequacy Ratios The Basle Capital Accord sets minimum capital adequacy ratios that supervisory authorities are encouraged to apply.

Tier 1 Leverage Ratio Definition

Capital Adequacy Ratio Definition Formula How To Calculate

Capital Adequacy Calculation Example Youtube

Capital Adequacy Class 12 Chap Lecture Outline 2 Introduction To Capital Adequacy What Is It And Why Is It Important What Are The Costs And Ppt Download

Risk Weighted Asset Definition Formula How To Calculate

Expected Decrease In Capital Adequacy Ratio Download Table

Capital Adequacy Ratio Car Overview And Example

Capital Adequacy Ratio Car Overview And Example

Risk Weighted Asset Definition Formula How To Calculate

Capital Adequacy Ratio Formula And Example How To Calculate It

Tier 1 Leverage Ratio Definition

Capital Adequacy Ratio Definition Formula How To Calculate

Tier 1 Leverage Ratio Definition

Risk Weighted Asset Definition Formula How To Calculate

Capital Adequacy Ratio Definition Formula How To Calculate

Capital Adequacy Ratio Car Overview And Example

Capital Adequacy Ratio Definition Formula How To Calculate

Capital Adequacy Ratio Definition Formula How To Calculate

Posting Komentar untuk "How To Calculate Capital Adequacy Ratio With Example"